| Uploader: | Hespinoza |

| Date Added: | 12.08.2015 |

| File Size: | 8.63 Mb |

| Operating Systems: | Windows NT/2000/XP/2003/2003/7/8/10 MacOS 10/X |

| Downloads: | 31276 |

| Price: | Free* [*Free Regsitration Required] |

IRS Form W-2 Download Printable PDF or Fill Online Wage and Tax Statement - | Templateroller

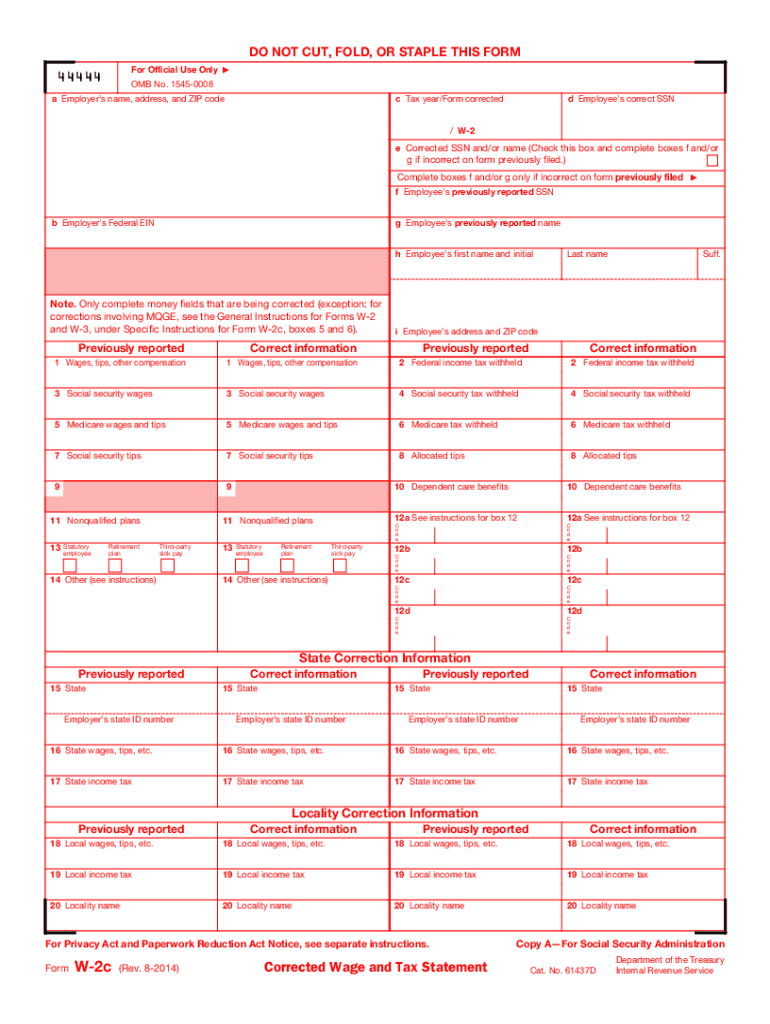

What is a W 2 Form The W-2 Form is a tax form for the Internal Revenue Service (IRS) of the United States. It is used to report wages paid to employees and taxes withheld from blogger.com the formal expression of the W 2 form is the "Wage and Tax Statement".As part of the employment relationship, the employer must fill out the W 2 form for each. A W-2 form, also known as a Wage and Tax Statement, is a form that an employer completes and provides to the employee so that they may complete their tax return. Form W-2 must contain certain information, including wages earned and state, federal, and other taxes withheld from an employee's earnings. Forms W-2 must be provided to employees. The IRS W-2 Forms are a series of six documents issued by the Internal Revenue Service (IRS). The main aim of these forms is to furnish the information about earnings to the employees, IRS, and the Social Security Administration (SSA) and to correct the already furnished information.

Fillable w-2 form 2018 download free pdf

The main aim of these forms is to furnish the information about earnings to the employees, IRS, and the Social Security Administration SSA and to correct the already furnished information. The forms consist of several copies. The filing rules are quite strict. You cannot print out the electronic versions of the documents for filing them via mail. File the electronic versions using e-filing service only. If you prefer paper versions, you must order them from the IRS. An extension to submit the forms is provided in limited cases, like natural disasters, fire, or any other extraordinary situation.

Failure to file the forms on time without a valid reason may result in penalties. The amount of penalties depends on the delay period. You can download the series from the link below. Use the IRS W-2 forms if you are an employer who has one or more employees and paid salary to these employees during the previous tax year. If you have several employees, you must file a separate form for every one of them. The set of forms also contains documents you can use to correct information you have already filed with the SSA or provided to your employees, and to report gambling winnings and the federal income tax withheld on those winnings.

The employee uses the information provided via the W-2 forms to prepare their individual tax returns Forms The main difference between Forms W-4 and W-2 is that the first one is an input document when the second is an output document.

Form W-4 is filled out by the employee when the Form W-2 is completed by the employer. The Form W-4, Employee's Withholding Allowance Certificate is a form the employees use to inform the employer about the amount they want to withhold from their pays.

Form W-2 is used by the employer to provide the employees with information about their year-end earnings and deductions. Mountain Dr. Besides, the SSA encourages you to send them the W-2 forms using e-filing service.

If you file and more forms at a time, fillable w-2 form 2018 download free pdf, you must use e-filing service only. Download the electronic versions of the W-2 forms below. If you prefer paper versions, you can send the order to: Internal Revenue Service, N. Mitsubishi Motorway, fillable w-2 form 2018 download free pdf, Bloomington, IL Your forms are usually delivered within 10 business days after the IRS receives your request.

The W-2 forms due date is January If the IRS grants you the permission, you will have fillable w-2 form 2018 download free pdf additional 30 days to file your forms with the Social Security Administration.

However, you still have to furnish the forms to your employees by the due date. Use this document to report the amount of withheld wages and taxes to the employee and appropriate authorities. The form is also known as the W-2 and is one of the crucial annual tax documents. This document was issued by the IRS, which can send you this form in a paper format, if you wish. Use this form to inform the Internal Revenue Service IRS about the amount of gambling winnings, as well as to report any federal tax withholdings.

Find more information and instructions in the form description. This form is filed to report American Samoa wages and withheld taxes.

It is not used for reporting income taxes in the United States. This form is filed to report Guam wages and tax deductions. The document was issued by the Internal Revenue Service IRSwhich can send you this form in a paper format, if you wish.

Table of contents. What Are Forms W-2 Used for? Documents By default By name By form number By size. View form Download. Url fillable w-2 form 2018 download free pdf this page:.

Fillable w-2 form 2018 download free pdf

Download Printable Irs Form W-2 In Pdf - The Latest Version Applicable For Fill Out The Wage And Tax Statement Online And Print It Out For Free. Irs Form W-2 Is Often Used In Irs W-2 Forms, U.s. Department Of The Treasury - Internal Revenue Service, United States Federal Legal Forms And United States Legal Forms/5(). A W-2 form, also known as a Wage and Tax Statement, is a form that an employer completes and provides to the employee so that they may complete their tax return. Form W-2 must contain certain information, including wages earned and state, federal, and other taxes withheld from an employee's earnings. Forms W-2 must be provided to employees. fillable w2 form free download - Free File Fillable Forms, W2 Mate , W2 Pro Professional Edition, and many more programs Fill in the IRS Form W-2 in PDF format. Free Publisher: IRS.

No comments:

Post a Comment